Cryptocurrencies are tokenised assets that represent value to the community. Not all cryptos are created equal though, there are better coins, better blockchains which are useful ones and inefficient blockchains as well. While working with cryptocurrency, the barriers to entry for trading are low especially for retail investors where users signup on exchange platforms like Coinbase, Binance, Kraken, Gemini etc and trade straight away (by filling up KYC details) with very low fees. Various cryptocurrencies are present on certain CEX (Centralized Exchange) platforms but not every coin is listed on exchanges.

If you are a user indulged in crypto trading over several years, you would have signed up for dozens of different exchanges. The reason could be to either try out a new feature or it could be only the platform that has a particular coin that you want. Because of this, users must have signed up on multiple exchange platforms which is time-consuming and to be hassled every time to manage all of them. As users have to sign in to each platform, verification and security processes, place trade, sign in back to check balances, all these steps add up to the number of exchanges one uses.

It’s high time we needed a solution for this right?

The solution to this problem, by enabling itself as an aggregator tool that can manage all of it for the users by not compromising on the security, which is ATANI.

So, in this article, let’s look at some key benefits, the vision of ATANI and some important points that you should know before trying out this tool.

Sound good? It’s time to dive deep…

Overview

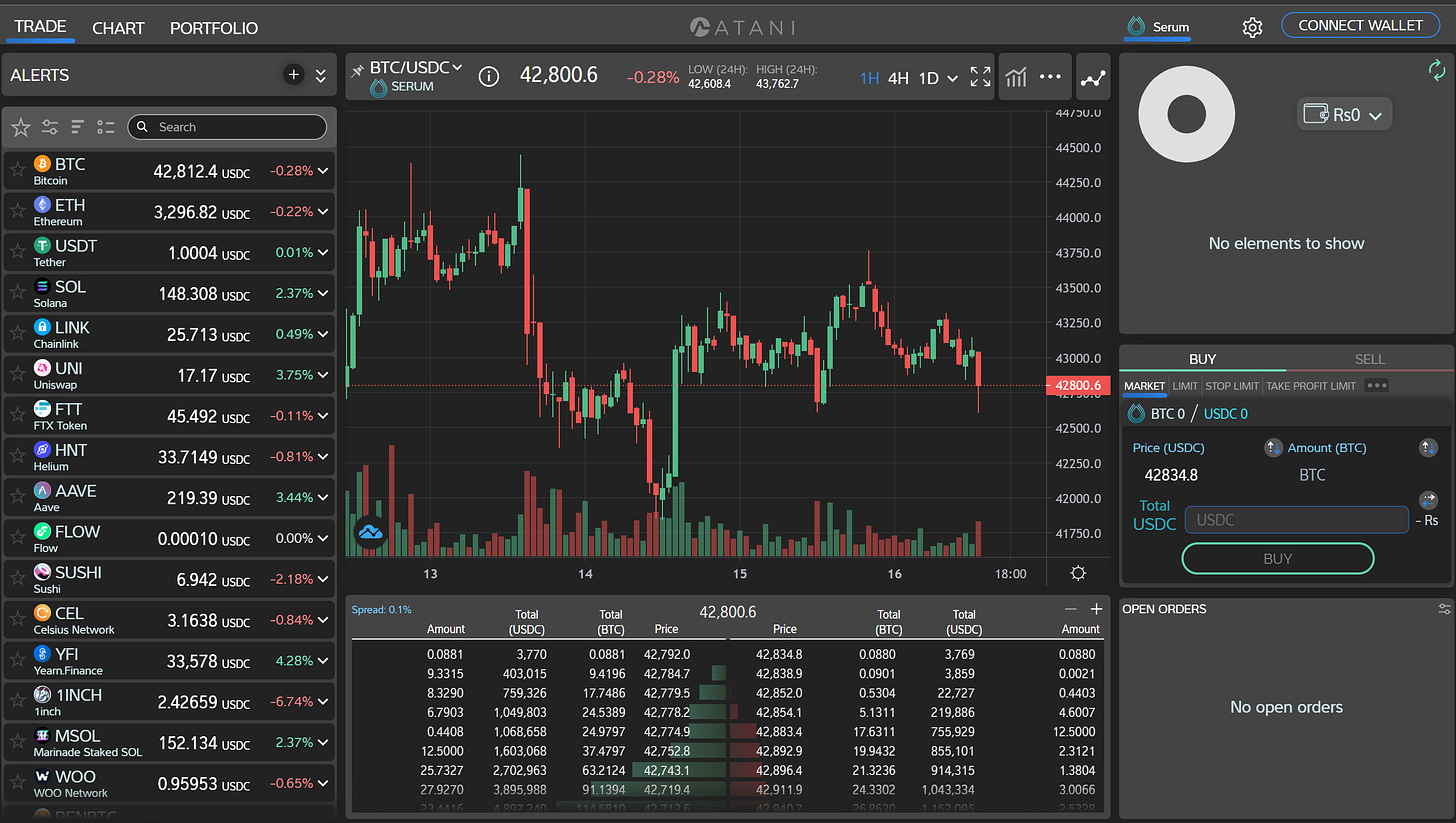

Atani primarily being a Central exchange platform (CEX), has created a DEX (Decentralised Exchange) aggregator powered by Solana and Serum which provides a fully on-chain order book, allowing applications like Atani to plug into Serum’s ecosystem. Atani is the most advanced Decentralized exchange (DEX) aggregator built on Solana. It enhances users experiences by bringing Advanced Orders via leveling up stop trading game, Technical analysis, Portfolio trackers, 24/7 alerts through SMS & Calls and Run Tax reporting. Users can enable these benefits just by connecting to their wallets. This is a super DEX platform because everything is done and constructed on a secure and non-custodial which means Atani can’t access user’s funds or API keys.

Boom! You don’t need to do any Know Your Customer (KYC) checks to use their app, above all it’s currently free to use.

Before deep-diving more into the platform benefits, let’s look at Atani’s team players.

Team

Atani is led by Paul Barroso and Hayde Barroso which is a sibling team with a ton of experience at investment banks and background in finance & crypto as well.

The founders themselves are crypto investors, traders, and raised a total of $7 million funding over 2 rounds. Atani is funded by 4 investors, where JME Ventures is the leading investor.

Conclusively, Atani is the (DEX) one-stop crypto trading platform which enables its users to integrate 20+ exchanges, technical analysis tools and automates tax reporting.

Key Features

Atani is a power platform with 20+ different popular exchanges and they are adding more by reducing the friction of users trading across CEXs and DEXs. The goal of Atani is to become the leading DEX aggregator for the Solana ecosystem by enabling best friction-less experience to crypto traders.

In its First Phase, some of the features Atani DEX brings on the table are:

On-chain Advanced Orders

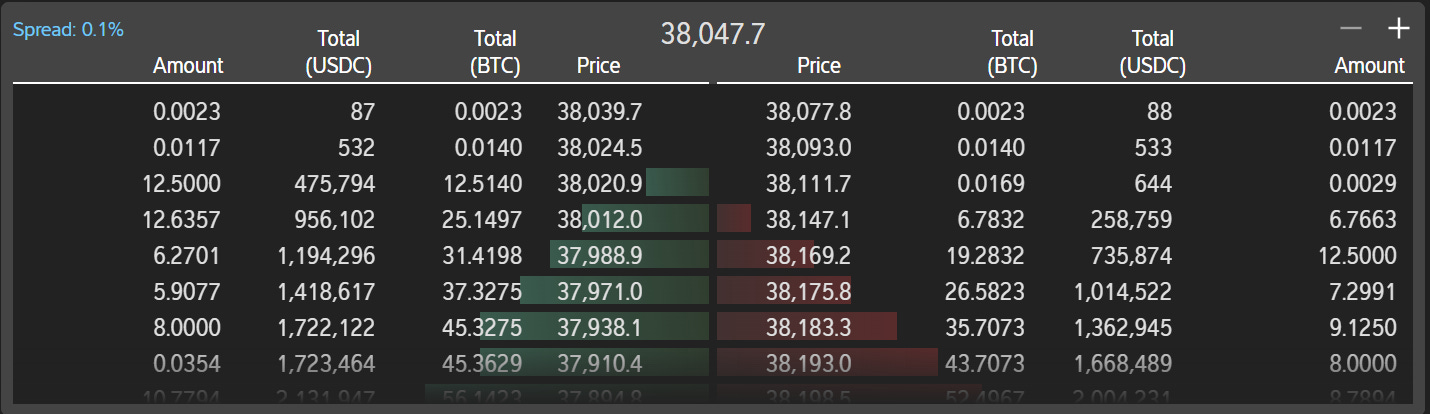

Users can Trade on Solana at the speed of light. With Atani DEX aggregator it offers intuitive interface, real-time order books, trading short-cuts and calculators etc.

Currently, in the market there is a feature of Market and Limit Orders which is supported in the ecosystem. Atani takes one step further by enabling –

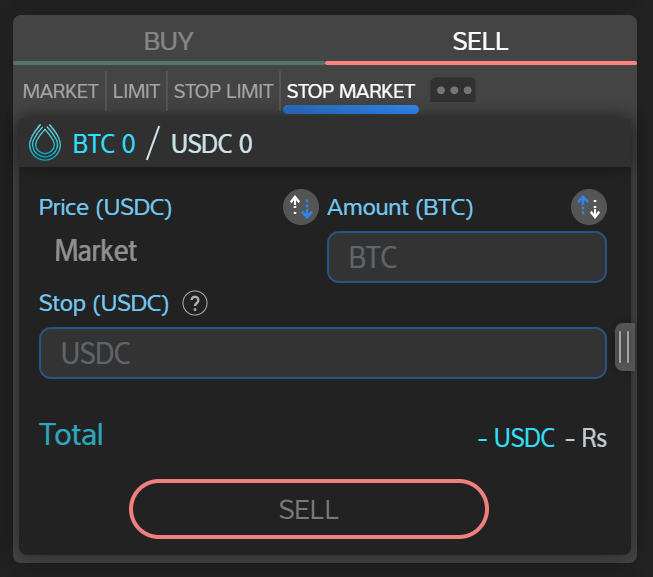

(i) Stop Loss

Stop Market Order – This is a combination of stop price and market order where once the stop price is reached, users’ market order will be immediately placed. This feature helps in order to limit users’ losses. Users can set prices and set amount that they wants to sell. Users can change the stop limit order whenever they can and execute accordingly.

Stop Limit Order – A combination of stop price and limit order. It is used to stop losses of user setting limit order and amount. Users can set stop price along with limit price and amount on their interface. Likewise, Stop Market Order, users can change and execute their orders accordingly.

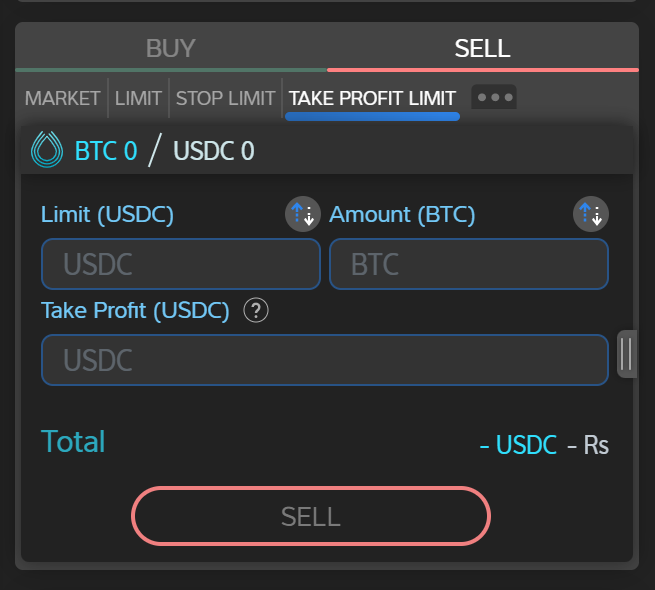

(ii) Take Profit

Take Profit Market Order – It is about profit price and market order. Once the profit price is reached, the users market order will be executed immediately. This feature is used to set targets and take profits home. Users must set the profit price and amount they are willing for and can execute the order by selling it. Users can change their Take Profit Limit Order any time.

Take Profit Limit Order – It is a combination of profit price and limit order. Once the profit price is reached, the order gets executed. Users will have to set the limit price and the amount they are willing for and execute the order and can access to change it anytime.

(iii) OCO

OCO Market Order – One Cancels the Other (OCO) allows users to place two orders at same time by sharing the same balance of limit order and stop market order. If either one of the order get fulfilled the other gets cancelled automatically. This feature allows users to place two different orders from same balance amount where one gets executed which helps to protect the profits (through limit order) and minimize the losses (through stop market order).

For example: If you place BTC by setting limit price at $60,000 to protect your profits and stop price at $45,000 to minimize losses, If BTC reached $60k then you will sell your Bitcoin taking profits to home. But, if price drops below $45k, you will automatically place a sell market order to limit your losses.

OCO Limit Order – It allows users to place two orders sharing the same balance by setting up limit order and stop limit order, which allows users to protect their profits (through limit order) and minimize losses (through stop limit order). To use this feature, users will have to set the amount they want to sell, set a limit price for profits, and stop price to reduce losses and execute the order.

Using the same Bitcoin example, but limit order is set to $44k and the stop price at $45k. Users will sell if BTC reaches $60k but if the price drops below $45k (as $45k is stop price), it will automatically place a sell limit order at $44,000 to limit users’ losses.

On-Chain Technical Analysis & Trading from Charts

Atani has some really fancy charting tools and they support chart types like 80+ technical indicators, 50+ drawing tools and other customized options. Users can open multiple layouts to analyse and trade directly from the charts. Users have the ability to save and load unlimited chart layouts all within their console. So, for chart traders, you don’t need to go back to trading view and Atani as you get all in one place.

Price Alerts and Portfolio Management

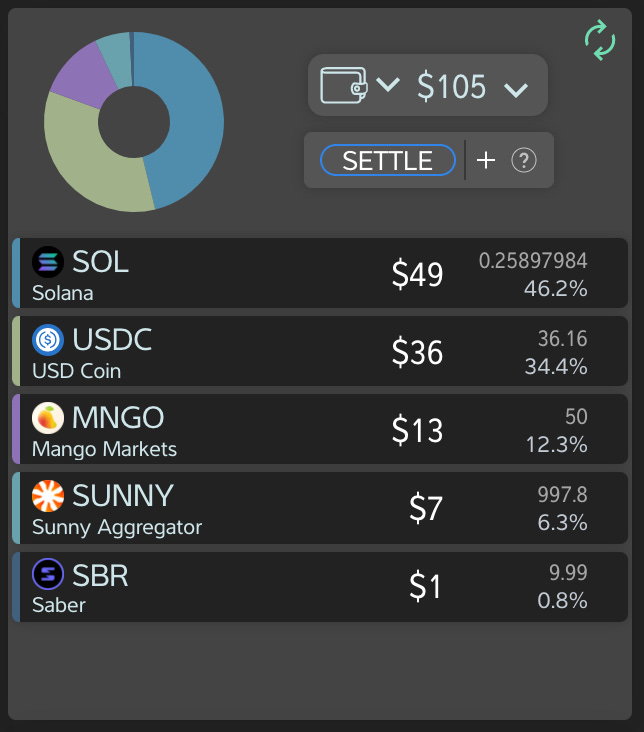

Users track and manage their portfolio and open orders from a single interface on the console with the best usability features.

Another handy feature that is unique to this trading platform is alerts. Users can setup alerts to give automatic text/call or email when certain coins hit a certain price which helps users to quickly trade from Atani.

Security

It is non-custodial console, i.e., when you connect wallet or API keys, the information is locally stored and encrypted which makes Atani and their servers do not have access to users’ wallets. The interesting fact is even if Atani servers are hacked, no users’ information is lost because they don’t have access to your passwords or personal identity. On Atani, API keys are restricted to read and trade purposes, no withdrawal ability is set within each exchange when you create API keys. Users don’t need to put out personal information at all.

Atani DEX is a tool to manage the trading experience easily but not an exchange platform and is currently free to use.

Unsettled Funds

Users can monitor their unsettled funds easily with Atani. They can monitor across all platforms and offer services to either manually or automate processes for traders to settle funds.

Road Ahead

In the Second Phase, Atani aims to strengthen its ecosystem by –

CEX – DEX Bridges

By improving the product integration of its CEX and DEX products, Atani aims to

Reduce friction for users trading across CEXs and DEXs platforms and

Improve streamline of liquidity transfer from CEXs to DEXs to become the ‘de facto’ door to the DeFi ecosystem for CEX users.

Multi-Chain Support

It aims to simplify the experience of users trading across multiple DEXs chains &

Reduce switching costs and increase growth to Solana and Serum.

Liquidity & Trading Volume Growth

Atani DEX will not be charging any fees on top of default fees of Serum, which drives 100% volume of Atani DEX to Serum.

The team believes trading on Serum through Atani DEX will provide the best experience to its users making the ecosystem one of the top drivers in terms of volume.

Conclusion

Atani is a great DEX aggregator on Solana enabling faster transactions up to 65,000 per second at low cost. Above this, the number of features it provides to traders helps the aggregator stand out in the market by providing seamless experiences to traders. I am looking forward to seeing some new features they will have in the future like integrating decentralised exchanges for example Uniswap which becomes super handy for users as it will cover 100% of the exchanges. You can check out the tool and you would definitely feel that you don’t have to log into all random exchanges every time whereas on Atani you can access all of them in one place.

Even though this is an early-stage product and potentially can have minor bug issues, this product is completely polished. Exciting times are ahead for Atani as they look to create differentiated long term value for users of the platform. Will definitely be watching and participating closely!

Community

You should go check out their twitter and join telegram group if you have more questions or want some help as you start to use yourself. The community is super helpful and will help you get over any issues you may encounter.